Introduction

Introduction

Banking Awareness is an important section in the employment-related competitive exams in India. In particular, exams like IBPS, RBI Grade B, SBI PO, RRB and other banking examinations. This article Banking Awareness Quiz 16 presents the model questions related to some Banking Awareness topics useful to the candidates preparing all Bank exams.

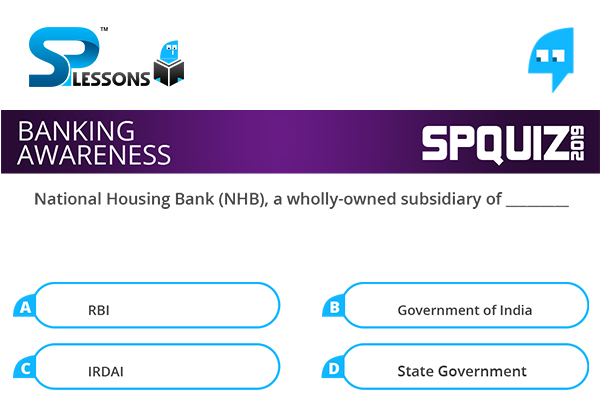

Q1

Q1

National Housing Bank (NHB), a wholly-owned subsidiary of _________

- A. RBI

B. Government of India

C. IRDAI

D. State Government

The National Housing Bank (NHB), once a wholly-owned subsidiary of Reserve Bank of India (RBI), has now been taken over by the government. The taking over of the Bank has been notified by the government after buying complete stake for Rs 1,450 crore from the central bank.

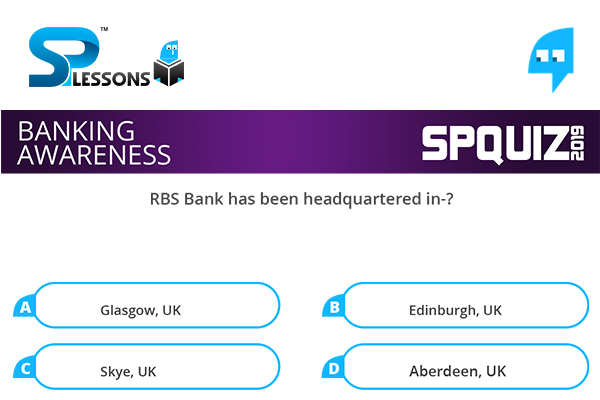

Q2

Q2

RBS Bank has been headquartered in-?

- A. Glasgow, UK

B. Edinburgh, UK

C. Skye, UK

D. Aberdeen, UK

The Royal Bank of Scotland, commonly abbreviated as RBS, is one of the retail banking subsidiaries of The Royal Bank of Scotland Group plc, together with NatWest and Ulster Bank. Headquarters of RBS is in Edinburgh, United Kingdom.

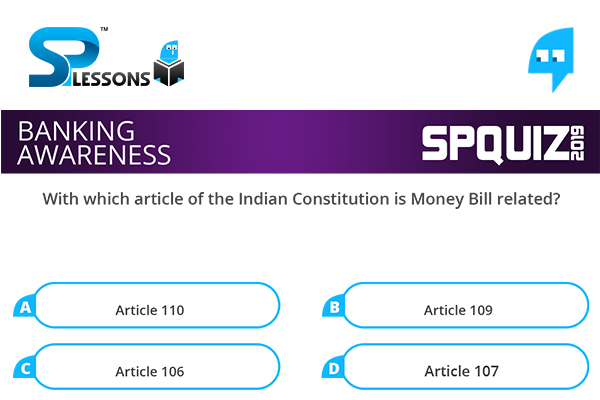

Q3

Q3

With which article of the Indian Constitution is Money Bill related?

- A. Article 110

B. Article 109

C. Article 106

D. Article 107

Article 110(3) of the Constitution of India categorically states that ‘if any question arises whether a Bill is a Money Bill or not.

Q4

Q4

Which of the following institutions is responsible for the supervision of RRBs?

- A. RBI

B. SEBI

C. NABARD

D. GOI

NABARD is responsible for regulating and supervising the functions of Co-operative banks and RRBs. In this direction, the Institutional Development Department of NABARD has been taking several initiatives in association with the Government of India and RBI to improve the health of Co-operative banks and Regional Rural Banks.

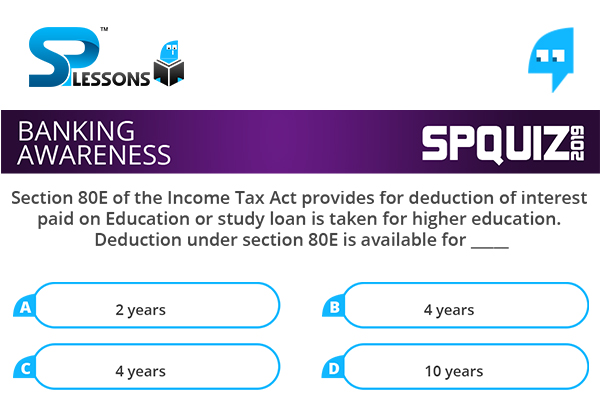

Q5

Q5

Section 80E of the Income Tax Act provides for deduction of interest paid on Education or study loan is taken for higher education. Deduction under section 80E is available for _____

- A. 2 years

B. 4 years

C. 8 years

D. 10 years

The deduction on education can be claimed only when you start the repayment and is available up to eight years, or until the payment of interest in full, whichever is earlier. This means, if you repay the loan within, say, five years, you can claim deduction only till such period.