Introduction

Introduction

Banking Awareness is an important section in the employment-related competitive exams in India. In particular, exams like IBPS, RBI Grade B, SBI PO, RRB and other banking examinations. This Banking Awareness Quiz – 3 presents the model questions related to some Banking Awareness topics.

Q1

Q1

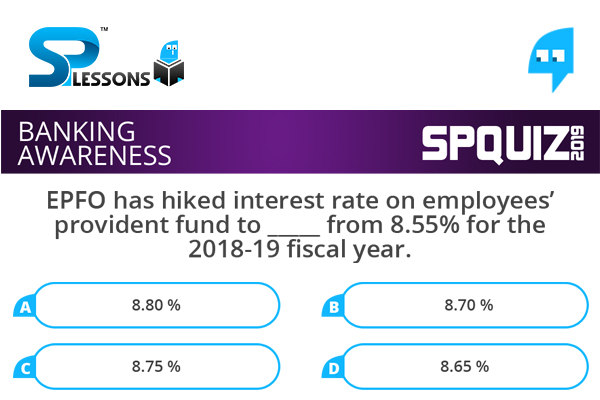

EPFO has hiked interest rate on employees’ provident fund to _____ from 8.55% for the 2018-19 fiscal year.

- A. 8.80 %

B. 8.70 %

C. 8.75 %

D. 8.65 %

Employees’ Provident Fund Organisation has hiked interest rate on employees’ provident fund to 8.65% from 8.55% for the 2018-19 fiscal year. The announcement was made by Labour Minister Santosh Gangwar.

Q2

Q2

Where is the headquarters of Organisation for Economic Co-Operation & Development (OECD)?

- A. Geneva

B. New York

C. Paris

D. Vienna

The headquarters of Organisation for Economic Co-Operation & Development (OECD) is in Paris, France.

Q3

Q3

FPI consists of securities and other financial assets passively held by foreign investors. What is the full from of FPI?

- A. Foreign Portfolio Investors

B. Financial Portfolio Investors

C. Foreign Product Investors

D. Foreign Portfolio Indian

Foreign Portfolio Investment (FPI) consists of securities and other financial assets passively held by foreign investors.

Q4

Q4

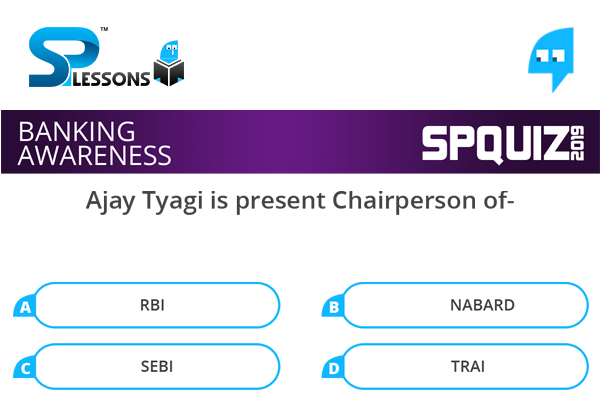

Ajay Tyagi is present Chairperson of-

- A. RBI

B. NABARD

C. SEBI

D. TRAI

Ajay Tyagi is the present Chairperson of SEBI.

Q5

Q5

The Central government has Relaxed angel tax norms for Start-ups from 7 years to ____ years. ?

- A. 20 years

B. 12 years

C. 5 years

D. 10 years

The Ministry of Commerce and Industry in an attempt to provide relief to and boost investments into start-ups in India has decided to simplify the process for them to get exemptions under the Income Tax Act, 1961. It will now recognize an entity as a start-up up to 10 years from the date of its incorporation or registration instead of the existing duration of 7 years. It will also recognize an entity as a start-up if its turnover for any of the financial years since its incorporation or registration does not exceed Rs 100 crore unlike the previous amount of Rs 25 crore.