Introduction

Introduction

Banking Awareness is an important section in the employment-related competitive exams in India. In particular, exams like IBPS, RBI Grade B, SBI PO, RRB and other banking examinations. This article Banking Awareness Quiz – 4 presents the model questions related to some Banking Awareness topics.

Q1

Q1

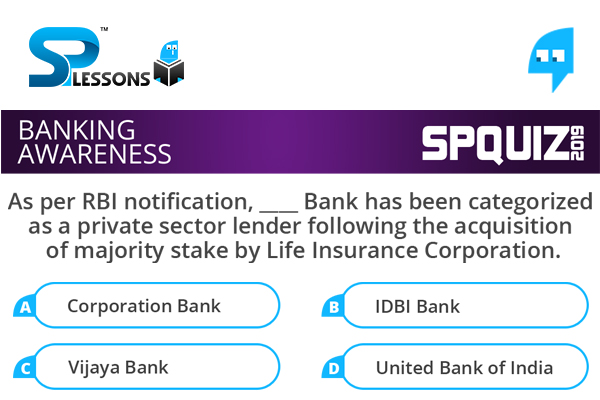

As per RBI notification, ____ Bank has been categorized as a private sector lender following the acquisition of majority stake by Life Insurance Corporation.

- A. Corporation Bank

B. IDBI Bank

C. Vijaya Bank

D. United Bank of India

As per RBI notification, IDBI Bank has been categorized as a private sector lender following the acquisition of majority stake by Life Insurance Corporation. IDBI Bank has been under the prompt corrective action framework of RBI that bans it from corporate lending and branch expansions, salary hikes and other regular activities. In January 2019, LIC completed the process of picking up a controlling 51% stake in the nearly crippled IDBI Bank. IDBI Bank has been categorized as a ‘private sector bank’ with effect from January 21, 2019.

Q2

Q2

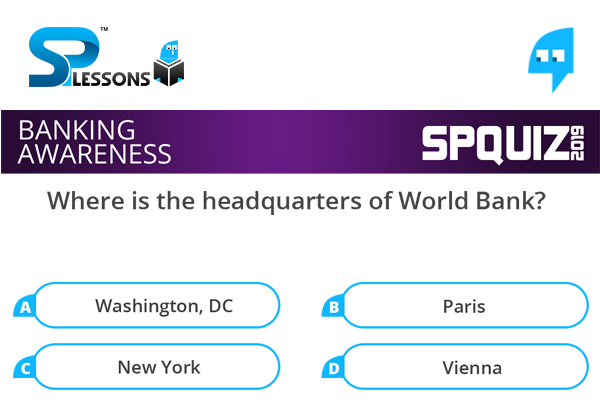

Where is the headquarters of World Bank?

- A. Washington, DC

B. Paris

C. New York

D. Vienna

Washington, D.C., United States is the headquarters of World Bank.

Q3

Q3

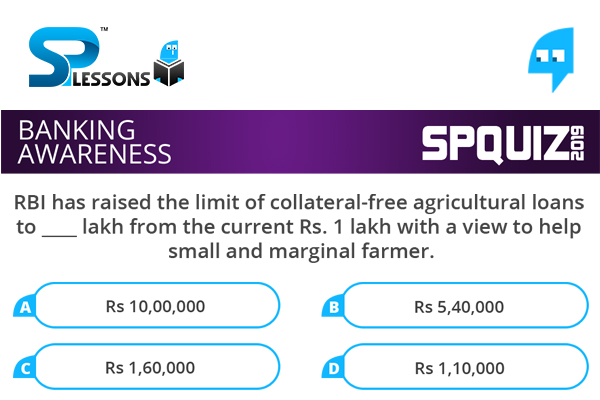

RBI has raised the limit of collateral-free agricultural loans to ____ lakh from the current Rs. 1 lakh with a view to help small and marginal farmer.

- A. Rs 10,00,000

B. Rs 5,40,000

C. Rs 1,60,000

D. Rs 1,10,000

The Reserve Bank of India raised the limit of collateral-free agricultural loans to Rs. 1.6 lakh from the current Rs. 1 lakh with a view to help small and marginal farmers. The central bank also decided to set up an internal working group (IWG) to review agricultural credit and arrive at a workable policy solution.

Q4

Q4

Which organisation has withdrew the 20% limit on investments by FPIs in corporate bonds of an entity with a view to encourage more foreign investments recently?

- A. IRDAI

B. SEBI

C. TRAI

D. RBI

The Reserve Bank of India (RBI) withdrew the 20% limit on investments by FPIs in corporate bonds of an entity with a view to encourage more foreign investments. As part of the review of the FPI investment in corporate debt undertaken in April 2018, it was stipulated that no FPI should have an exposure of more than 20% of its corporate bond portfolio to a single corporate (including exposure to entities related to the corporate).

Q5

Q5

National Bulk Handling Corporation Pvt. Ltd. is an Indian commodity and collateral management company based in-

- A. New Delhi

B. Mumbai

C. Kolkata

D. Chennai

National Bulk Handling Corporation Pvt. Ltd. is an Indian commodity and collateral management company based in Mumbai. NBHC is wholly owned by True North, a private equity major.