Introduction

Introduction

Banking Awareness is an important section in the employment-related competitive exams in India. In particular, exams like IBPS, RBI Grade B, SBI PO, RRB and other banking examinations. This article Banking Awareness Quiz – 9 presents the model questions related to some Banking Awareness topics useful to the candidates preparing all Bank exams.

Q1

Q1

Which of the following Bank has partnered with credit profiler CreditVidya to improve the lender’s customer experience recently?

- A. Yes Bank

B. RBL Bank

C. Karnataka Bank

D. South Indian Bank

RBL Bank has partnered with credit profiler CreditVidya to improve the lender’s customer experience. Through this partnership, the private sector lender will be able to gain significant insights into its customer base. By acquiring richer customer insights, RBL will be able to segment its customers better, offer them relevant credit products and build custom scorecards.

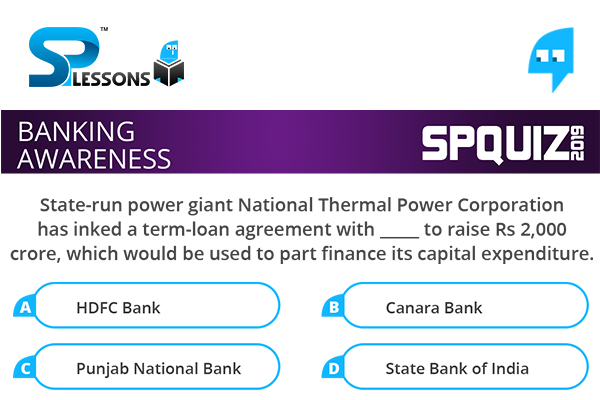

Q2

Q2

State-run power giant National Thermal Power Corporation has inked a term-loan agreement with _____ to raise Rs 2,000 crore, which would be used to part finance its capital expenditure.

- A. HDFC Bank

B. Canara Bank

C. Punjab National Bank

D. State Bank of India

State-run power giant National Thermal Power Corporation has inked a term-loan agreement with Canara Bank to raise Rs 2,000 crore, which would be used to part finance its capital expenditure. The loan has a door to door tenure of 15 years and will be utilised to part finance the capital expenditure of the NTPC.

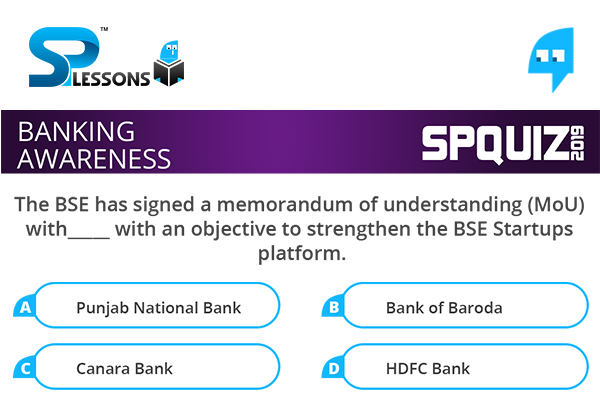

Q3

Q3

The BSE has signed a memorandum of understanding (MoU) with _____ with an objective to strengthen the BSE Startups platform.

- A. Punjab National Bank

B. Bank of Baroda

C. Canara Bank

D. HDFC Bank

The BSE has signed a memorandum of understanding (MoU) with HDFC Bank with an objective to strengthen the BSE Startups platform. The MoU has been signed to spread more awareness on the benefits of the listing of startups on this BSE startup platform.

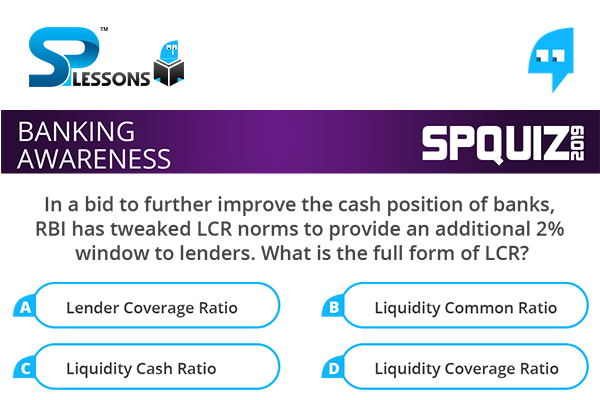

Q4

Q4

In a bid to further improve the cash position of banks, RBI has tweaked LCR norms to provide an additional 2% window to lenders. What is the full form of LCR?

- A. Lender Coverage Ratio

B. Liquidity Common Ratio

C. Liquidity Cash Ratio

D. Liquidity Coverage Ratio

In a bid to further improve the cash position of banks, RBI has tweaked Liquidity Coverage Ratio (LCR) norms to provide an additional 2% window to lenders. As per RBI Governor Shaktikanta Das, this move will harmonise the liquidity requirements of banks and release additional money for lending.

Q5

Q5

Which of the following Bank has entered into an MoU with Bharti AXA Life Insurance Company to distribute the latter’s life insurance products recently?

- A. Yes Bank

B. Kotak Mahindra Bank

C. South Indian Bank

D. Karnataka Bank

Karnataka Bank has entered into an MoU with Bharti AXA Life Insurance Company to distribute the latter’s life insurance products. The bank will be able to provide a wide choice of life insurance products to its customers across 836 branches, supported by the products of Bharti AXA Life Insurance Company.