Introduction

Introduction

What is an Insurance?

According to the dictionary and different insurance policies, Insurance is defined as “an arrangement by which a company or the state undertakes to provide a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a specified premium.” Thus, Insurance is a means of protection from financial loss. Insurance in short is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. The insurance provider is known as an insurer, insurance company, insurance carrier or underwriter. Insurance Awareness is an important section in several recruitment exams in India, primarily in the insurance sector.

Insurance Awareness Quiz 8 includes Questions and Answers related to the following topics: History of Insurance sectors in India, Insurance Organizations in India, Important Insurance Terms, Insurance Abbreviations & Insurance related information. Insurance Awareness Quiz 8 is extremely important for aspirants of Insurance related recruitment’s such as UIIC, OICL, LIC, HFL, AAO, etc.

Q1

Q1

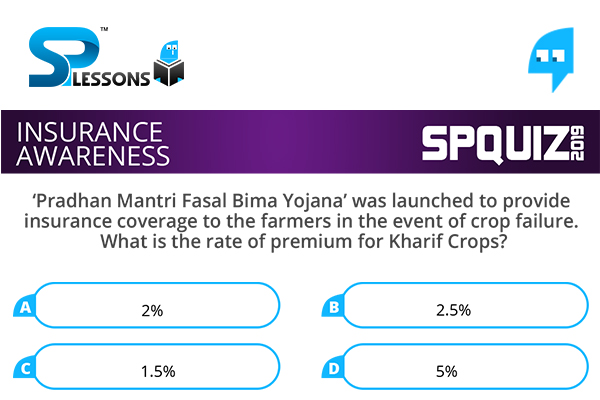

‘Pradhan Mantri Fasal Bima Yojana’ was launched to provide insurance coverage to the farmers in the event of crop failure. What is the rate of premium for Kharif Crops?

- A. 2%

B. 2.5%

C. 1.5%

D. 5%

The Pradhan Mantri Fasal Bima Yojana (Prime Minister’s Crop Insurance Scheme) was launched by Prime Minister of India Narendra Modi on 18 February 2016. It envisages a uniform premium of only 2 per cent to be paid by farmers for Kharif crops, and 1.5 per cent for Rabi crops. The premium for annual commercial and horticultural crops will be 5 per cent.

Q2

Q2

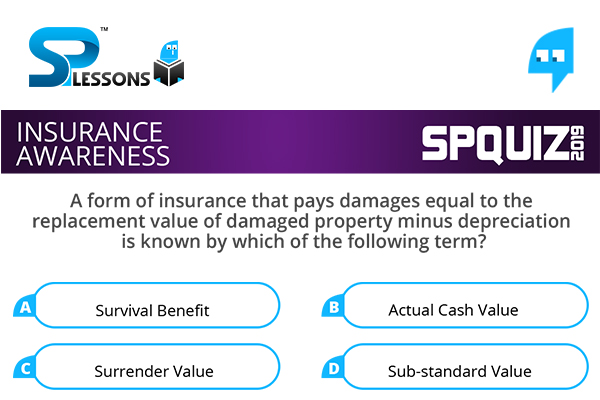

A form of insurance that pays damages equal to the replacement value of damaged property minus depreciation is known by which of the following term?

- A. Survival Benefit

B. Actual Cash Value

C. Surrender Value

D. Sub-standard Value

In the property and casualty insurance industry, Actual Cash Value (ACV) is a method of valuing insured property, or the value computed by that method. Actual Cash Value (ACV) is not equal to replacement cost value (RCV). ACV is computed by subtracting depreciation from replacement cost.

Q3

Q3

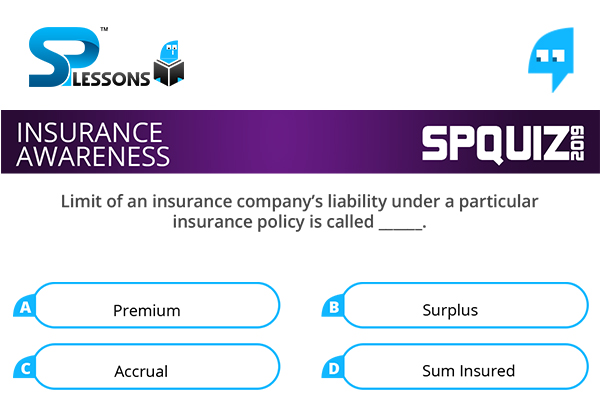

Limit of an insurance company’s liability under a particular insurance policy is called ______.

- A. Premium

B. Surplus

C. Accrual

D. Sum Insured

Limit of an insurance company’s liability under a particular insurance policy is called Sum Insured.

Q4

Q4

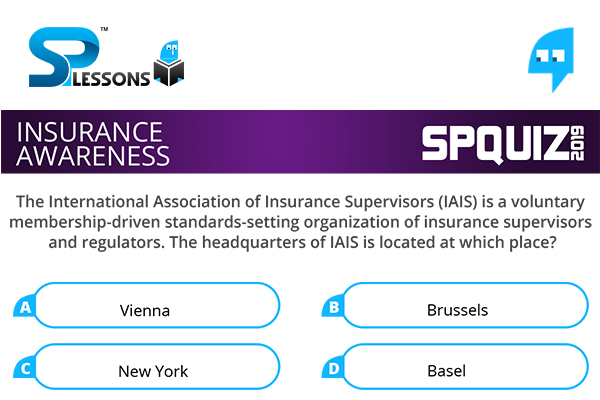

The International Association of Insurance Supervisors (IAIS) is a voluntary membership-driven standards-setting organization of insurance supervisors and regulators. The headquarters of IAIS is located at which place?

- A. Vienna

B. Brussels

C. New York

D. Basel

The IAIS (International Association of Insurance Supervisors) is a nonprofit organization headquartered in Basel, Switzerland. The IAIS is hosted by the Bank for International Settlements (BIS).

Q5

Q5

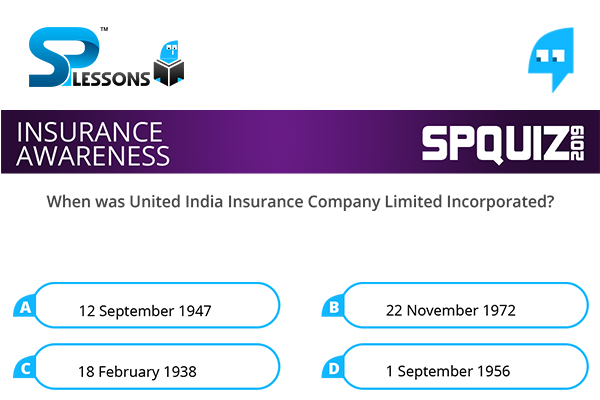

When was United India Insurance Company Limited Incorporated?

- A. 12 September 1947

B. 22 November 1972

C. 18 February 1938

D. 1 September 1956

United India Insurance Company Limited was incorporated as a Company on 18th February 1938. General Insurance Business in India was nationalized in 1972.

Other Articles

Study Guide

Study Guide

Exams

Exams

| Competitive Exams - Entrance Exams | |||||

|---|---|---|---|---|---|

| Category | Notification | ||||

| UG | NSTSE 2020 | RIMC Admission 2020 | WBJEE EVETS 2019 | PUBDET 2019 | |

| Diploma | HPBOSE D.El.Ed CET 2019 | Goa Diploma Admissions 2019 | CIPET JEE 2019 | ||

| Degree | WBJEE JENPAUH |

JNEE 2019 |

|||

PG |

GATE 2020 |

ATMA 2019 |

XAT 2020 |

JIPT 2019 | |

| Click Here For – All India Entrance Exam Notifications | |||||

Daily CA

Daily CA

Job-Alerts

Job-Alerts

SP Quiz

SP Quiz

| Competitive Exams - Practice Sets | |

|---|---|

| Category | Quiz |

| English Language | Spotting Errors |

| Quantitative Aptitude | Data Interpretation |

| Compound Interest | |

GK

GK

| General Knowledge for Competitive Examinations | |

|---|---|

| Topic | Name of the Article |

| GK - World | Multinational Companies CEOs |

| Signs and Symbols | |

| GK - India | Indus Valley Civilization |

| Chalukya Dynasty and Pallava Dynasty | |

| GK - Abbreviations | Indian Government Policies Abbreviations |

| Science Information Technology Abbreviations | |

| GK - Banking & Insurance | Important Banking Interview Questions |

| Banks and Headquarters | |

| GK - Science & Technology | Human Body Facts |

| Web Portals | |

| Father of Different Fields – Science & Technology | |