Introduction

Introduction

What is an Insurance?

According to the dictionary and different insurance policies, Insurance is defined as “an arrangement by which a company or the state undertakes to provide a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a specified premium.” Thus, Insurance is a means of protection from financial loss. Insurance in short is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. The insurance provider is known as an insurer, insurance company, insurance carrier or underwriter. Insurance Awareness is an important section in several recruitment exams in India, primarily in the insurance sector.

Insurance Awareness Quiz 3 includes Questions and Answers related to the following topics: History of Insurance sectors in India, Insurance Organizations in India, Important Insurance Terms, Insurance Abbreviations & Insurance related information. Insurance Awareness Quiz 3 is extremely important for aspirants of Insurance related recruitment’s such as UIIC, OICL, LIC, HFL, AAO, etc.

Q1

Q1

IRDAI has announced that it will adopt RBC regime from the current solvency principle to improve protection for policyholders. What is the full form of RBC?

- A. Risk Based Capacity

B. Repo Based Capital

C. Rating Based Capital

D. Risk Based Capital

Insurance regulator IRDAI has announced that it is in the process of moving towards the Risk-Based Capital (RBC) regime to improve protection for policyholders. The decision to move to the RBC structure from the current solvency principle regime was taken after recommendations of a panel which gave its report.

Q2

Q2

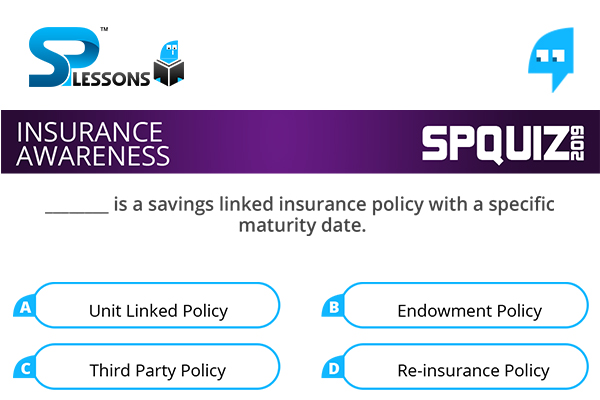

________ is a savings linked insurance policy with a specific maturity date.

- A. Unit Linked Policy

B. Endowment Policy

C. Third Party Policy

D. Re-insurance Policy

An Endowment Policy is a savings linked insurance policy with a specific maturity date. if an unfortunate event by way of death or disability occur to you during the period, the Sum Assured will be paid to your beneficiaries. On your surviving the term, the maturity proceeds on the policy become payable.

Q3

Q3

“G” in ‘DICGC’ stands for which of the following term?

- A. GDP

B. Government

C. Gilts

D. Guarantee

G in “DICGC” stands for – Guarantee (Deposit Insurance and Credit Guarantee Corporation). Deposit Insurance and Credit Guarantee Corporation (DICGC) is a subsidiary of Reserve Bank of India. It was established on 15 July 1978 under Deposit Insurance and Credit Guarantee Corporation Act, 1961 for the purpose of providing insurance of deposits and guaranteeing of credit facilities.

Q4

Q4

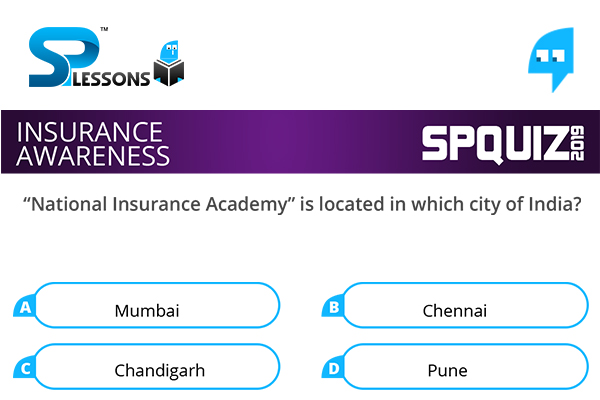

“National Insurance Academy” is located in which city of India?

- A. Mumbai

B. Chennai

C. Chandigarh

D. Pune

The National Insurance Academy (NIA) is situated in Pune, India. It was founded in 1980 by the Finance Department of the Indian government with capital patronage from LIC and public sector general insurance industry.

Q5

Q5

When a contract ceases to be enforceable at law, then it is called as

- A. Legal Contract

B. Void contract

C. Life contract

D. Voidable contract

The law relating to contracts in India is governed by The Indian Contract Act , 187B. A void contract is a contract which ceases to be enforceable by law.

Other Articles

Study Guide

Study Guide

Exams

Exams

| Competitive Exams - College Entrance Exams | |||

|---|---|---|---|

| Category | Notification | ||

| Diploma | NITC New Delhi | Goa Diploma Admissions 2019 | |

| Click Here For – All India Entrance Exam Notifications | |||

Daily CA

Daily CA

Job-Alerts

Job-Alerts

SP Quiz

SP Quiz

| Competitive Exams - Practice Sets | |

|---|---|

| Category | Quiz |

| Quant Aptitude | Probability |

| Speed and Time | |

| Reasoning Ability | Puzzles |

| English Language | Spotting Errors |

GK

GK

| General Knowledge for Competitive Examinations | |

|---|---|

| Topic | Name of the Article |

| GK - World | International Organizations Headquarters – IGO & INGO |

| National International Significant Dates | |

| GK - India | Information Technology |

| Indian History Timeline – Quick Read | |

| GK - Abbreviations | Computer Abbreviations |

| International Organizations Abbreviations | |

| GK - Banking & Insurance | World Stock Exchange |

| Banking Sector Risks | |

| GK - Science & Technology | Chemical Elements |

| Web Portals | |

| Famous Websites | |